Use our free online Home Loan EMI Calculator to instantly calculate your housing loan EMI (Equated Monthly Installment). With just a few inputs – loan amount, interest rate, and loan tenure – you can get an accurate monthly EMI amount. This will help you plan your finances better and make informed decisions about your housing loan.

How to Use the Home Loan EMI Calculator?

Using our Home Loan EMI Calculator is as easy as 1-2-3:

- Enter the Loan Amount: Input the total amount you wish to borrow for your home loan.

- Input the Rate of Interest: Provide the annual interest rate offered by the lender.

- Select Loan Tenure: Choose the loan repayment period in years.

Once you have entered these details, click the “Calculate EMI” button. Our housing loan EMI calculator will quickly display your monthly EMI amount.

Home Loan EMI Calculator

| Principal Amount | Interest Amount | Total Amount Payable |

|---|---|---|

| ₹ | ₹ | ₹ |

Benefits of Using Our Home Loan EMI Calculator

- Quick and Accurate: Get instant and precise EMI calculations.

- Easy to Use: Simple interface requiring minimal inputs.

- Financial Planning: Helps in budgeting and planning your home loan repayment.

- Amortization Schedule: Download detailed EMI tables for a clear repayment plan.

- Comparison Tool: Compare different loan offers to find the best one for your needs.

- Prepayment Insights: Understand the impact of prepayments on your EMI and loan tenure.

- Interest Savings: Calculate potential savings by varying loan tenure and interest rates.

- Accessibility: Available online anytime, anywhere, for your convenience.

Frequently Asked Questions (FAQs)

1. What is an EMI?

EMI stands for Equated Monthly Installment. It is the fixed amount you pay every month towards repaying your home loan. The EMI comprises two components:

- Principal Amount: The portion of the loan amount repaid.

- Interest Amount: The interest on the outstanding loan amount.

2. How is home loan EMI calculated?

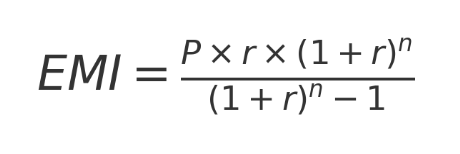

The home loan EMI is calculated using the formula: EMI = P x r x (1+r)^n / [(1+r)^n-1]

Where,

P = Principal loan amount.

n = Loan tenure in months.

r = Monthly interest rate.

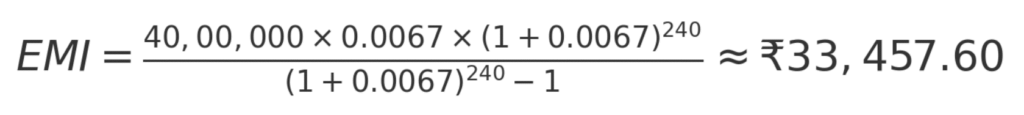

Take a look at this example to understand how is home loan EMI calculated -

Example: What is the EMI for 40 lakh home loan?

Suppose you take a housing loan of ₹40,00,000 at an annual interest rate of 8% for a tenure of 20 years (240 months). Then your EMI for 40 lakhs home loan will be ₹33,458

Where,

- Loan Amount (P) = ₹40,00,000

- Annual Interest Rate = 8%

- Monthly Interest Rate (r) = 8% / 12 = 0.67% = 0.0067

- Tenure (n) = 240 months

EMI = 40,00,000 * 0.0067 * (1+0.0067)^240/ ((1+0.0067)^240 - 1) ≈ ₹33,458

3. What factors affect my home loan EMI?

Several factors can influence your home loan EMI, including:

- Loan Amount: Higher loan amounts lead to higher EMIs.

- Interest Rate: Higher interest rates increase the EMI.

- Loan Tenure: Longer tenures result in lower EMIs but more interest paid over time.

- Credit Score (CIBIL Score): A higher credit score can lead to lower interest rates, reducing the EMI.

- Down Payment: A higher down payment reduces the loan amount and, consequently, the EMI.

- Income Stability: Steady and higher income can help secure better loan terms.

- Debt-to-Income Ratio: Lower existing debts can result in better loan terms and lower EMIs.

4. Can I prepay my home loan?

Yes, most lenders allow prepayment of the loan. Check with your lender for any prepayment charges or terms.

5. How does the loan tenure affect my EMI?

A longer tenure results in a lower EMI but more interest paid over the loan's duration. Conversely, a shorter tenure means a higher EMI but less interest overall.

6. What is an amortization schedule?

An amortization schedule is a detailed table showing the breakdown of each EMI into principal and interest components over the loan tenure.

7. Can I use this calculator for other types of loans?

While this calculator is designed for home loans, it can be used for other loans with similar repayment structures.

8. What are the current home loan interest rates?

Home loan interest rates can vary based on multiple factors, such as your credit score, loan amount, whether you are a salaried employee or a self-employed professional, and lender policies. As of now, the home loan interest rate typically ranges from 6.5% to 9% per annum. It is important to check with individual lenders for the most accurate and updated rates.

If you are planning to buy or construct your 1st dream home, then you can get a home loan subsidy under the Pradhan Mantri Awas Yojana scheme. But first, you need to check Pradhan Mantri Awas Yojana eligibility and find out how much home loan subsidy you can get using the PMAY Subsidy Calculator.